Your Digital Account Manager

VUE works with leading multinational insurers, brokers and claims specialists to speed up claims resolution, control costs, digitise operations, and ultimately make the claims process more efficient.

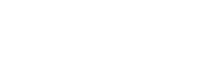

We do this through our white-labelled platform, VUEhub, which is an innovative software solution combining all your claims, policy and risk management services in one central place.

The easy-to-follow portal helps clients maximise the benefits of their telematics investment, as well as supporting fleets to reduce their accident frequency and claims severity.

>> Contact us todayWhy choose VUE as your risk management partner?

VUE’s vehicle CCTV and video telematics offer a comprehensive picture of an accident and assists in decisions on liability. Our online platform, VUEhub, provides all your risk, policy and claims management tools in one place and has been helping insurers for over 20 years to support their clients in reducing risk and maximising the benefits of their telematics investment. Also, the innovative software can be white-labelled which helps to strengthen brand identity.

Reduce Claims Costs and Accident Frequency

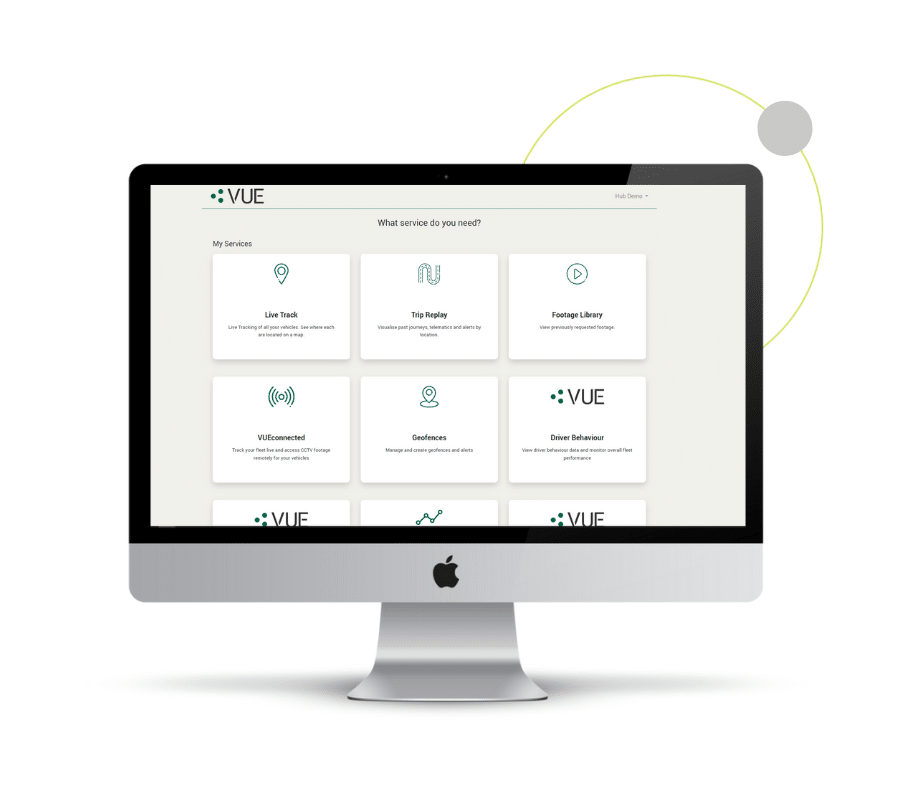

VUEcloud, part of the VUEhub range of services,is a secure claims media storage and exchange platform that enables you to rapidly obtain incident footage from your policyholder and securely share it with relevant parties.

This process completely digitises operations as it allows for self-service by the client. As decisions on liability can be made quickly and clients defended from fraudulent claims, this cuts down claims cycle time and reduces costs. Clients can also use footage as part of their driver training which can help to reduce the risk of future incidents.

>> Learn more about VUEcloud

Gain Clear Insights on Fleet Performance

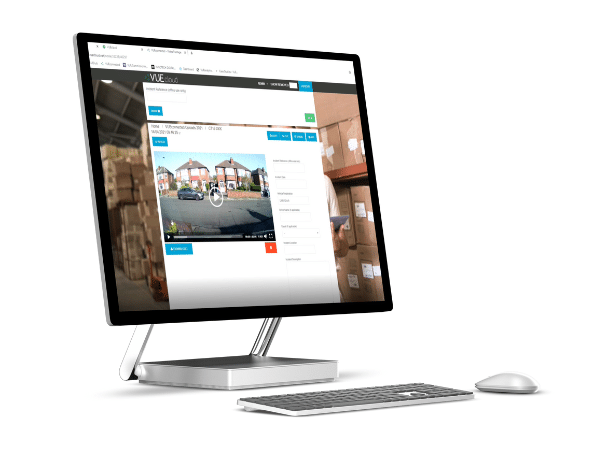

The Driver Behaviour Dashboard provides you with a comprehensive picture of how a fleet is performing without the need for a client to invest further in additional vehicle hardware.

The easy-to-understand graphs and charts offer information on key fleet health indicators, meaning relevant parties can make more informed decisions on risk management.

Similarly, the Claims Dashboard combines fleet performance with key claims and accident data to enable users to identify trends and take corrective actions.

>> Request a demo of our dashboards

Digitise Operations and Strengthen Connections with Clients

As VUEhub allows for self-service either by the broker or the policyholder, it helps you digitise your entire process which saves you time and money.

You can also communicate key messages to your clients such as important guides from your claims teams or policy documents which they can access in one place.

>> Talk to us about digitising operations

Reduce claims frequency with revolutionary technology

As an insurer, the cheapest accident your client can be involved in is the one that never happens. This is why VUE have developed innovative road safety technology to help further reduce claims frequency.

Innovative technology to protect pedestrians and cyclists

Prevent accidents caused by distraction e.g., phone usage

Avoid collisions with low bridges or other road height restrctions

Fleet managers receive real-time alerts to keep on top of fleet risk

Who we work with...

Want to find out more about VUE?

Contact us today