Everything you need to know about crash for cash Scams

What are crash for cash scams?

Crash for cash is a type of motor insurance fraud that involves scammers staging an accident in an attempt to gain compensation. These schemes have seen a rise on UK roads in recent years with the Insurance Fraud Bureau estimating they cost the insurance industry around £340 million annually with a single collision potentially costing tens of thousands of pounds.

The scams usually fall into one of three categories:

-

• Staged accidents - fraudsters stage a collision with each other so they can both claim damages on their insurance

-

• Ghost accidents - a scammer submits a claim despite no accident actually taking place in the hopes the incident will not be fully investigated

-

• Induced accidents - a fraudster will deliberately cause an accident with an innocent road user by driving unpredictably or erratically, or using manipulation tactics to make it appear as though the other motorist was at fault

A typical example of an induced accident involves a driver slamming on their brakes suddenly and giving the driver behind insufficient time to be able to stop safely, forcing them to crash into the rear of the vehicle.

However other techniques fraudsters use include 'flash for cash' where a driver signals another motorist and beckons them out of a side road or junction but the scammer continues driving and speeds up, causing them to collide. Also, scammers sometimes remain stationary, often at night or on a quiet road, leading the innocent driver to drive closer to assess the situation and then the fraudster reverses suddenly.

What is the impact of crash for cash scams?

Increased insurance costs

Fleets are needlessly paying out significant amounts yearly on fraudulent claims that are at no fault of their drivers.

Vehicle downtime

Operations will be disrupted as a result of vehicles being taken off the road to repair any damages.

Threat to reputation

If the incident is shared on social media, this could potentially cause damage to the fleet's reputation.

How can you protect your drivers from crash for cash scams?

- Vehicle cameras

Vehicle CCTV that captures the incident and shows the moments leading up to the collision, for example, the scammer seemingly giving way to the fleet driver or slamming on their brakes at short notice provides undeniable evidence of who was at fault and clearly establishes how the collision happened.

Simply relying on witness statements is not enough to protect your drivers as sometimes fraudsters place other people around the scene who will support the false statement. The footage taken from a vehicle camera helps to verify the credibility of your driver's account and can be shared with an insurer to clear your driver of liability.

Also, the presence of cameras may be enough to deter scammers from targeting your drivers in the first place so it's a good idea to place stickers on the vehicle to make this clear to others.

>> Learn more about vehicle cameras2. Secure media exchange platform

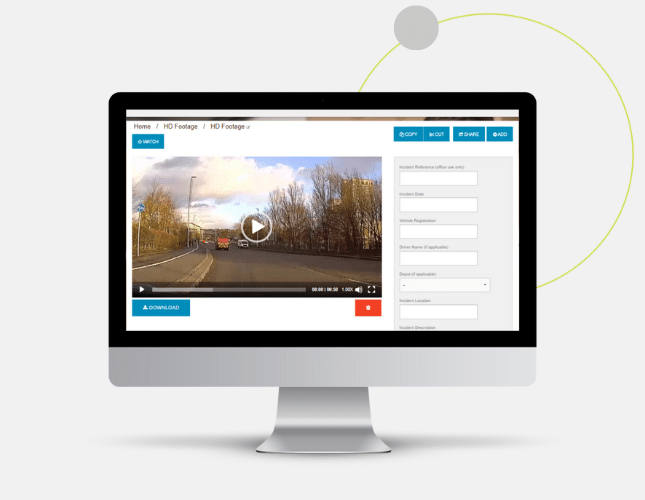

Obtaining footage from the vehicle and sharing it with an insurer is vital in defending drivers but as time progresses, the cost of the claim increases which is why it's important these fraudulent claims are settled quickly.

Innovative software solutions, such as VUEcloud, enable fleet managers to share footage directly with an insurer and ensure decisions on liability can be made rapidly.

The ability to remotely download footage means there is no need to take the vehicle off the road to remove the hard drive which lessens the impact the incident has on operations.

As VUEcloud is a secure media exchange platform, operators can be reassured the sensitive footage will never end up in the wrong hands.

Footage can also be used as part of driver training on how to avoid falling victim to these scams.

>> Learn more about VUEcloud

3. Driver training

As mentioned above, there are measures fleet operators can take to help prevent their drivers from being targeted by these fraudsters. Showing footage of drivers caught up in cash for crash schemes, or even erratic and unpredictable driving behaviour, can help them spot the signs and learn how to react to them.

Some tips to give to your drivers include...

-

• Avoid tailgating - leave at least a 2-second gap between other vehicles in good conditions, at least 4 seconds in wet weather, or even more in very poor conditions

-

• Anticipate hazards - look for unusual behaviour from other drivers e.g., drivers slowing down for no obvious reason or other drivers/passengers looking back at the excessively

-

• Make your own safe judgements - do not assume that it is safe to proceed just because someone has signalled to give you way as this could be a manipulation tactic

It's also important drivers stay focused while on the road as this not only enables them to spot any warning signs, but if they're found to be showing signs of distracted behaviour at the time of the incident e.g., using their phone, this makes proving they weren't at fault more difficult.

>> Learn more about preventing distracted behaviourWant to learn more about reducing insurance costs?

Contact us today